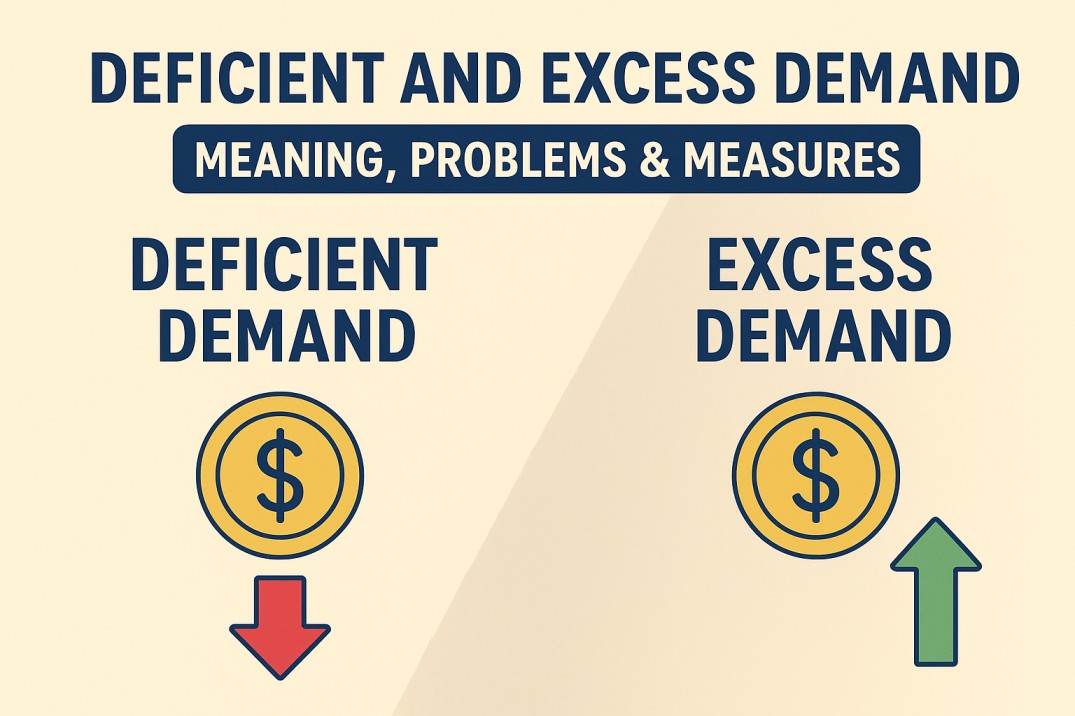

⚖️ Problems of Deficient and Excess Demand and Their Corrective Measures – Class 12 Economics

Ever noticed how sometimes there’s too little demand for goods, and businesses struggle to sell — while at other times, prices shoot up because everyone’s buying more than what’s available?

These are two sides of the same coin in economics — Deficient Demand and Excess Demand.

Let’s break this down simply and clearly.

💡 Meaning of Aggregate Demand (AD)

Before we understand the two problems, let’s quickly recall what Aggregate Demand means.

Aggregate Demand = The total demand for all goods and services in an economy during a given period.

It includes:

👉 Consumption (C)

👉 Investment (I)

👉 Government expenditure (G)

👉 Net exports (X – M)

So, AD = C + I + G + (X – M)

When AD doesn’t match the economy’s full employment level of output, problems arise — either deficient or excess demand.

📉 Deficient Demand

🔎 Meaning:

Deficient demand occurs when aggregate demand is less than the aggregate supply at the full employment level.

In simple words — people are not spending enough, businesses don’t sell enough, and production slows down.

💥 Causes of Deficient Demand:

- Decrease in consumer spending (due to low income or savings)

- Decrease in investment (due to low business confidence)

- Fall in government expenditure

- Decrease in exports

- Increase in taxes (reduces disposable income)

⚠️ Effects of Deficient Demand:

- Fall in output and employment

- Recession in the economy

- Deflationary pressure (prices fall)

- Wastage of resources

- Low profit and business closures

💊 Measures to Correct Deficient Demand (Deflationary Gap):

The government and central bank use expansionary policies to increase demand.

🏛️ 1. Fiscal Measures (by Government):

- Increase government spending on infrastructure, education, etc.

- Reduce taxes so people have more disposable income.

- Increase transfer payments like pensions, subsidies, and scholarships.

💵 2. Monetary Measures (by Central Bank):

- Reduce the bank rate → cheaper loans for businesses.

- Lower Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) → banks can lend more.

- Buy government securities (OMO) → increases money supply.

🧠 Goal: Encourage spending, raise investment, and bring the economy back to full employment.

📈 Excess Demand

🔎 Meaning:

Excess demand occurs when aggregate demand exceeds aggregate supply at full employment level.

It means people are spending too much, but there aren’t enough goods and services available.

💥 Causes of Excess Demand:

- Increase in consumer spending (higher income or optimism)

- Increase in investment (due to low interest rates)

- Rise in government expenditure

- Increase in exports

- Decrease in taxes (leaves people with more money)

⚠️ Effects of Excess Demand:

- Inflation (rise in prices)

- Over-utilization of resources

- Trade deficits (imports rise)

- Mal-distribution of income (rich get richer)

- Boom conditions that can lead to economic instability

💊 Measures to Correct Excess Demand (Inflationary Gap):

The government and central bank use contractionary policies to reduce demand.

🏛️ 1. Fiscal Measures (by Government):

- Reduce government spending

- Increase taxes to reduce disposable income

- Reduce transfer payments

💵 2. Monetary Measures (by Central Bank):

- Increase bank rate → loans become expensive

- Raise CRR and SLR → banks lend less

- Sell government securities (OMO) → reduces money in circulation

🧠 Goal: Control inflation and bring demand back to sustainable levels.

⚖️ Comparison: Deficient vs Excess Demand

| Basis | Deficient Demand | Excess Demand |

|---|---|---|

| Meaning | AD < AS at full employment | AD > AS at full employment |

| Nature | Deflationary gap | Inflationary gap |

| Prices | Fall | Rise |

| Employment | Unemployment | Over-employment |

| Policy Type | Expansionary | Contractionary |

🧠 Conclusion

Both deficient demand and excess demand are harmful to the economy — one causes unemployment, the other brings inflation.

That’s why governments and central banks constantly try to maintain a balance using fiscal and monetary tools.

In short — too little demand slows growth, and too much overheats the economy.

The key is to keep Aggregate Demand = Aggregate Supply at the full employment level.

✍️ Quick Recap

| Problem | Effect | Corrective Measure |

|---|---|---|

| Deficient Demand | Recession, Unemployment | Expansionary Fiscal & Monetary Policy |

| Excess Demand | Inflation, Overheating | Contractionary Fiscal & Monetary Policy |

:max_bytes(150000):strip_icc():format(webp)/marginalutility-cff85ddfd620484f8afbf9d3f6cf4b74.jpg)

:max_bytes(150000):strip_icc():format(webp)/TermDefinitions_Utility-e42a7528caa347f9b1af149065ab2b9d.jpg)