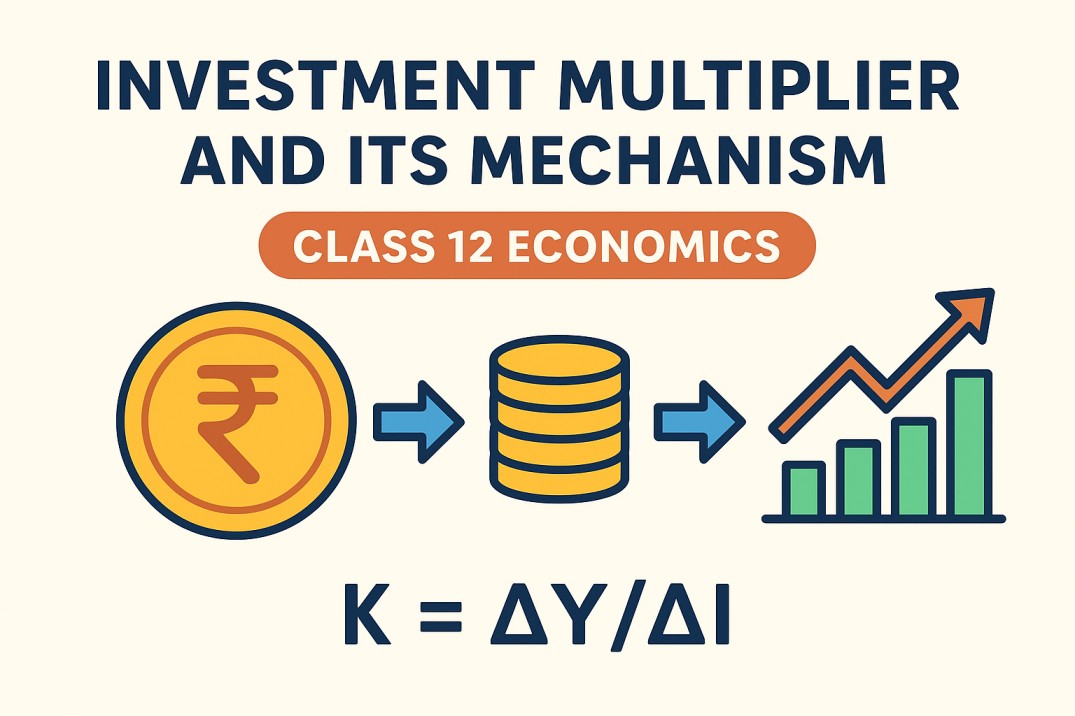

💰 Investment Multiplier and Its Mechanism – Class 12 Economics

Have you ever noticed how one small investment can create a chain reaction in the economy? Like when a new factory opens in a town — it doesn’t just create jobs inside the factory but also boosts shops, transport, and local services around it.

That’s exactly what the Investment Multiplier explains!

🌍 What is an Investment Multiplier?

The Investment Multiplier is an economic concept that shows how an initial increase in investment leads to a greater increase in national income.

In simple words — it tells us how much total income the economy generates when there’s a rise in investment.

📘 Definition (by Keynes):

“The investment multiplier is the ratio of the change in income to the change in investment.”

Formula:

K = \frac{ΔY}{ΔI}

- K = Multiplier

- ΔY = Change in income

- ΔI = Change in investment

💡 Understanding with an Example

Imagine the government invests ₹1 crore to build a highway.

- The construction workers earn wages.

- They spend that money on food, clothes, and rent.

- The shopkeepers and landlords then earn income and spend again.

This cycle of spending and earning keeps repeating — creating a multiplied effect on total income.

So, if a ₹1 crore investment increases national income by ₹5 crore, then the multiplier (K) = 5.

🔁 Mechanism of Investment Multiplier

Let’s break down how the multiplier actually works step by step 👇

1. Initial Investment

The government or businesses invest money — say, on building roads, factories, or housing projects.

This directly increases income for workers, suppliers, and contractors.

2. Increase in Income

People who get paid now have more money to spend. Their consumption level rises.

3. Increase in Consumption

As people spend more, demand for goods and services increases.

Producers respond by making more goods and hiring more workers.

4. Further Increase in Income

The newly hired workers also earn income and spend it — repeating the cycle.

5. The Process Continues

Each round of spending becomes smaller and smaller because people save a part of their income.

This process continues until the additional income becomes negligible.

That’s how the initial investment “multiplies” the total national income.

📊 Mathematical Relation

The size of the multiplier depends on how much people consume and how much they save.

K = 1 / (1 – MPC)

Where:

- MPC (Marginal Propensity to Consume) = fraction of additional income that people spend

- MPS (Marginal Propensity to Save) = fraction of additional income that people save

- And since MPC + MPS = 1, the multiplier can also be written as

K = 1 / MPS

🔢 Example:

If people spend 80% of their additional income (MPC = 0.8), then

K = 1 / (1 - 0.8) = 1 / 0.2 = 5

🌱 Importance of Investment Multiplier

-

Boosts Economic Growth:

Encourages investment by showing how small spending can lead to big growth. -

Helps in Policy Making:

Governments use it to plan fiscal policies and understand the impact of public spending. -

Explains Employment Growth:

More investment → More production → More jobs. -

Useful During Recession:

Helps in recovery by showing how public investment can kickstart demand.

⚠️ Limitations of Investment Multiplier

- Works best only when there’s unused capacity in the economy.

- If people save too much, the multiplier effect weakens.

- In developing countries, leakages (like imports, taxes, and corruption) reduce the effect.

- Takes time to show results, as spending and income circulate slowly.

🧠 Conclusion

The Investment Multiplier is like a ripple in water — one small investment creates waves that spread across the entire economy.

It’s a powerful tool that explains how spending boosts income, employment, and overall growth.

For Class 12 students, just remember — more spending means more income, and the multiplier shows how much more.

✍️ Quick Recap Table

| Concept | Formula / Meaning | Example |

|---|---|---|

| Multiplier (K) | K = ΔY / ΔI | If ₹1 crore → ₹5 crore, K = 5 |

| MPC + MPS | = 1 | Always true |

| K in terms of MPC | K = 1 / (1 – MPC) | If MPC = 0.8, K = 5 |

| Mechanism | Investment → Income → Consumption → More Income | Cycle continues until effect fades |

:max_bytes(150000):strip_icc():format(webp)/marginalutility-cff85ddfd620484f8afbf9d3f6cf4b74.jpg)

:max_bytes(150000):strip_icc():format(webp)/TermDefinitions_Utility-e42a7528caa347f9b1af149065ab2b9d.jpg)